#1 Tax Optimization Platform in US

Most investors optimize what they earn, not where they hold it. Our tax planning services help you save $15,000+ through smarter investing and tax optimization strategies your accountant might miss.

You're leaving thousands on the table

Most investors miss these critical tax optimization strategies that could save thousands annually

Missing Tax Loss Harvesting

Your losing stocks could offset $5,000 in capital gains, but you haven't harvested them before year-end. Tax loss harvesting is one of the best tax planning strategies in the United States, yet 80% of investors never use it.

Wrong Account Placement

Your bonds sit in taxable brokerage accounts while stocks are locked in your 401k, costing you $3,000 annually in unnecessary taxes. Asset location optimization - placing investments in the right account types - is a tax optimization strategy most advisors overlook.

Paying Double Taxes

You're managing wealth across US and India, paying full taxes in both countries. DTAA (Double Tax Avoidance Agreement) benefits and foreign tax credits could save you $10,000+ every year. Cross-border taxation requires specialized tax planning services from US tax planning consultants who understand international tax treaties.

Underusing Retirement Accounts

You maxed your 401k contribution but missed HSA, backdoor Roth, and mega backdoor strategies worth $8,000/year in tax savings. Strategic retirement account planning goes beyond basic contributions - it's about tax optimization across all available vehicles.

Tax strategies to help you save more of your money

Helps you uncover every eligible tax-saving opportunity, from simple deductions to complex cases →

Three Steps to Serious Tax Savings

Our tax planning services combine AI technology with certified tax professionals

All Your Accounts, One Clear View

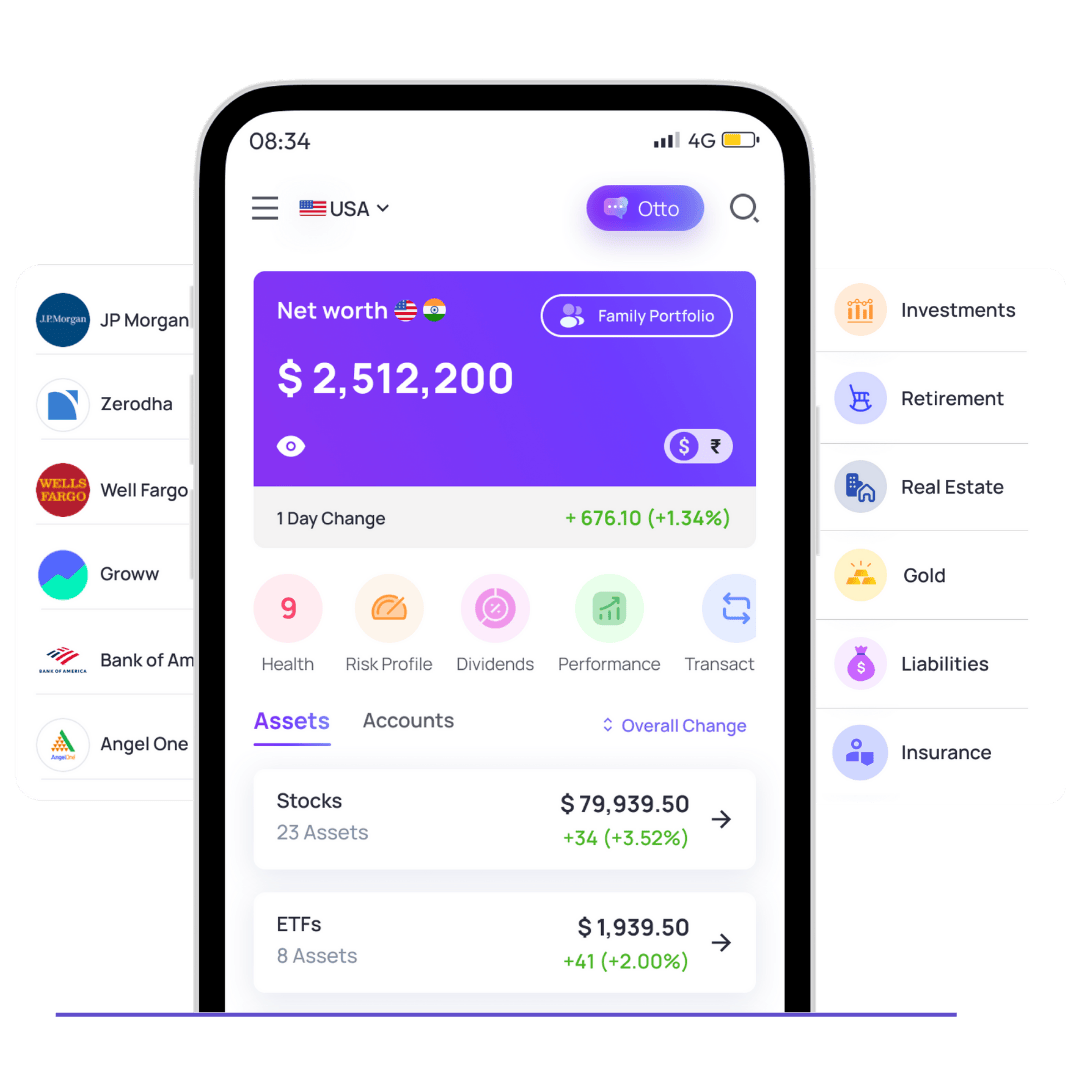

Otto AI securely connects your investment accounts, retirement plans, and tax documents across borders. Our tax planning software analyzes your complete financial picture - US and India accounts, 401k, IRA, HSA - to identify every tax optimization strategy available.

AI Uncovers Strategies You Might Miss

Our tax planning software for individuals identifies missed opportunities like tax loss harvesting, DTAA credits, asset location issues, and retirement strategies tailored to you. The AI analyzes 10,000+ data points daily to find the best tax planning strategies your advisor might miss.

We Handle the Work, You Keep the Savings

Book a call with our team of certified US tax planning consultants. Our CPAs, CFPs, and cross-border tax specialists create a personalized tax planning strategy and handle the complexity. You get year-round tax advisory support, not just once-a-year filing.

Managing wealth across countries? We specialize in that.

If you have investments, property, or income in both US and India, you face unique tax complexity. Wealth management tax planning through DTAA benefits, foreign tax credits, FBAR compliance, and optimal account structuring can save you $10,000 - $50,000 annually. Our experts navigate this daily.

Meet Your US Tax Planning Consultants

Tax strategy gets complex fast. That's why you get access to our team of certified US tax planning consultants specializing in cross-border taxation

Strategies tailored to you

Click strategies to see how they work

High Earners ($200k+)

Everything you need for tax-smart investing

Comprehensive tax planning and management - click any feature to learn more

Otto AI Assistant

Smart Tax Alerts

Portfolio Analysis

Cross-Border Support

Document Hub

Expert Consultations

Tax Filing Services

Portfolio Sync

Frequently asked questions

Everything you need to know about tax planning and optimization

Start saving today

Free 30-minute strategy call. We'll show you exactly where you're losing money to taxes.

No obligation. No sales pitch. Just honest analysis of your opportunities.